Famous Analyst Drops Bombshell: BlackRock Is Stocking Up On XRP And This Cheap $0.015 Banking Token?

For weeks, whispers have circled around institutional desks about an unusual pattern forming in on-chain activity. Then came the leak that BlackRock isn’t just observing the XRP narrative anymore — they’re participating in it. That leak, attributed to a famous analyst, lit up Crypto Twitter and sent the XRP community into a frenzy. After all, BlackRock’s presence has historically preceded enormous institutional shifts. But the surprise wasn’t that the firm might be circling XRP; it was the second asset mentioned in the same breath: a $0.015 DeFi banking token called Paydax Protocol (PDP).

BlackRock And The New XRP Narrative

To understand the magnitude of the statement, it helps to rewind. Last year, Ripple unveiled RLUSD (its institutional-grade stablecoin) and began linking it to major players in tokenized finance. Before the official announcement, the famous analyst revealed that fund managers BlackRock and VanEck were already exploring tokenization pilots involving Ripple’s RLUSD.

If true, that would mark the first time the world’s largest asset manager officially touched the XRP ecosystem, a move that could trigger a multi-cycle re-rating across liquidity corridors. This development coincides with renewed optimism around BlackRock’s crypto ETF expansion plans, sparking a wave of speculative energy reminiscent of early-2021 Bitcoin ETF rumors.

But there’s another layer famous analysts are watching: not just which assets benefit from today’s infrastructure, but which protocols might underpin tomorrow’s.

The Parallel Bet: XRP’s Banking Vision vs Paydax’s Banking Engine

Here’s where Paydax Protocol and its native token, PDP, enter the frame. While XRP focuses on cross-border payments and settlement speed, Paydax Protocol builds the next tier of decentralized banking: a system where both digital and real-world assets become usable collateral.

Both projects, at their core, speak the same language — liquidity, velocity, and institutional relevance. But they operate on different layers of the financial stack:

| Layer | XRP | Paydax Protocol |

| Core Purpose | Payment settlement & liquidity bridge | Collateral banking & liquidity unlock |

| Market Focus | Institutional cross-border transfers | DeFi users + real-world asset owners |

| Tech Model | RippleNet infrastructure | Smart-contract escrow & lending pools |

| Token Role | Bridge asset for payments | Utility token powering yield, governance, liquidity |

| Institutional Relevance | Legacy integrations | Native DeFi + RWA composability |

The PDP Edge

The famous analyst speculated that BlackRock’s digital portfolio expansion strategy now involves acquiring positions in early-stage, high-utility assets before they hit major exchanges. With PDP priced at just $0.015, the math speaks for itself — it’s the kind of asymmetrical opportunity institutions drool over.

PDP powers a DeFi architecture built to make assets productive without forcing holders to sell. Here’s how:

- Multi-Asset Lending: Borrow against BTC, ETH, or even tokenized collectibles and art.

- Liquid Escrow Layer: Unlock liquidity while retaining ownership of locked or staked tokens.

- Staking & Governance: PDP holders participate in yield generation (up to 20% APY) and key system decisions.

- Security & Compliance: Audited by Assure DeFi, with partnerships and integrations for KYC and pricing accuracy.

Paydax Protocol calls this its “Banking Protocol Layer.” It’s a structure designed to mirror the safety of traditional banking while preserving DeFi’s flexibility. That’s precisely why some famous analysts are drawing parallels between Paydax Protocol’s PDP and XRP: both aim to bridge finance’s two worlds, and both are attracting institutional-style attention at their earliest stages.

From Institutional Signals to Early-Stage Opportunity

Every major crypto bull cycle starts with whispers, usually a signal from the top before the narrative reaches retail. Suppose BlackRock is exploring XRP integration through Ripple’s new infrastructure. In that case, PDP represents the next logical step down the stack: the system that gives those same institutional assets liquidity and yield.

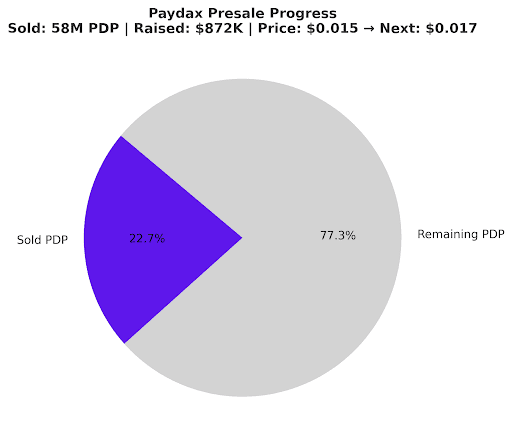

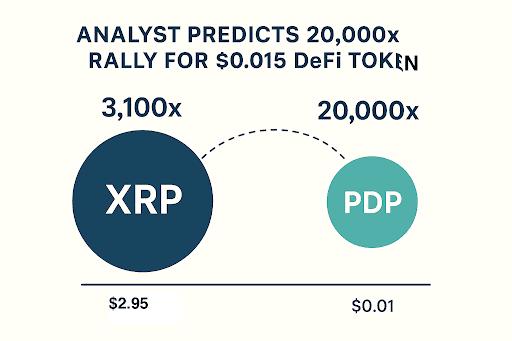

At $0.015, the math is striking: even a move to $3.00 — a price famous analysts have floated in presale projections — would represent a 20,000x return from today’s entry level. And presale demand suggests that conviction is already forming. Over $872,000 has been raised so far, with 58 million PDP tokens sold, signaling steady accumulation well before listings.

Why PDP Could Ride the XRP Wave

While BlackRock’s increasing XRP interest continues to dominate headlines, what’s often missed is how capital rotations unfold. Historically, large inflows into high-cap coins like XRP precede liquidity rotations into early-stage infrastructure plays.

That means as institutional money re-enters XRP, it naturally seeks exposure to ecosystems building on the same financial thesis. Paydax Protocol fits that role perfectly, with PDP’s extensive utility on a system that takes XRP’s liquidity ethos and extends it into full-scale decentralized banking. In simple terms: if XRP brings the money in, Paydax Protocol helps make that money move.

A Quiet Convergence

BlackRock’s name alone moves markets. But the real story may be what comes next — the layer of finance that tokenizes, lends, and redeploys that capital across DeFi. As the famous analyst’s “bombshell” continues to circulate, traders are beginning to recognize the symmetry: XRP as the signal, PDP as the shadow move.

With the Paydax Protocol still in presale and priced at $0.015, early exposure may not just be a bet on another DeFi token; it could be a front-row seat to the next institutional banking standard. If you’re wondering how to position for the next big thing, join the presale at the ground level today and use the promo code PD80BONUS to enjoy an 80% bonus on your purchase.

Join The Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Source: Famous Analyst Drops Bombshell: BlackRock Is Stocking Up On XRP And This Cheap $0.015 Banking Token?